Blog

How Businesses Can Avoid Identity Verification Fraud in 2019?

With a bulk of customers using online services, businesses wish to digitise their operations and ...

Explore More

Explore More

Blog

Divergent AML/CFT Rules and Cross-border Payment Challenges – What FATF Has to Say?

While addressing AML/CFT requirements for cross-border payments, the global financial watchdog, F...

Explore More

Explore More

Blog

Adverse Media Screening Requirements and Why Do FIs Need It?

The financial services industry is under a lot of regulatory requirements recently, and for all t...

Explore More

Explore More

Blog

Pandora Papers Pushing Global Authorities to Bridge Regulatory Gaps

The Pandora Papers have made headlines for not only exposing offshore dealings of the rich but al...

Explore More

Explore More

Blog

Embedding online identity verification methods for enterprise security

The internet knows a lot about us now. And businesses are using this information to verify our di...

Explore More

Explore More

Blog

Japanese FSA to Beef Up AML Systems from Fiscal 2021

Growth in South Asia has far exceeded that in any other country over the past few years and digit...

Explore More

Explore More

Blog

AML Screening | Fighting the War Against Terrorist Financing & Money Laundering

Money laundering and terrorist financing have become a global concern. In the US alone, approxima...

Explore More

Explore More

Blog

KYC/AML Compliance – A Safeguard Against Money Laundering in the NFT Market

The instability in the non-fungible token (NFT) sector can be seen in the record sales of $25 bil...

Explore More

Explore More

Blog

Know Your Driver – Urgency of Identity Verification for Mobility service Providers

Scams have been at the forefront whenever a new tool is made available. The same goes for ride-sh...

Explore More

Explore More

Blog

Preventing Criminal Abuse of the Australian Crypto Market with Shufti’s AML Screening Services

Cryptocurrencies have been around for a decade and investors have found a feasible option for inv...

Explore More

Explore More

Blog

Gaming Industry Crimes and KYC/AML Solutions – What Shufti Can Offer

From the world’s glitziest gaming development to betting shops on the high streets, the global ga...

Explore More

Explore More

Blog

The Latest AML Violations and the Role of Transaction Monitoring

In the evolving regulatory landscape, combating financial crimes has become a top priority of reg...

Explore More

Explore More

Blog

Intelligent Security Systems & Digital ID Verification

Most technology solutions present a compromise between convenience and security to their users. I...

Explore More

Explore More

Blog

The Top 10 Benefits of the Know Your Customer Lifecycle

In this digital age, where transactions occur remotely and identity theft is rising, establishing...

Explore More

Explore More

Anti Money Laundering, Blog, Business Technology, Financial Crime / AML, Identity & KYC

Global Economies are joining forces with FATF against money laundering

Financial Action Task Force (FATF) has been very keen on eliminating financial crime (money laund...

Explore More

Explore More

Blog

Louisiana Age Verification Compliance Updates 2024

Age verification is crucial for online tasks like purchases and communication. The inte...

Explore More

Explore More

Blog

Customer Risk Assessment – A Landmark Approach to Fight Identity Fraud

Identity theft is the most prominent cybercrime which has raised alarms for global law enforcemen...

Explore More

Explore More

Blog

Top 13 Cybersecurity Predictions for 2020

Cybersecurity threats are ostensibly ubiquitous in this internetworking infrastructure. Internet-...

Explore More

Explore More

Blog

How Online ID Verification Supports Age-restricted Sellers?

The online stores selling age-restricted products like gaming services, medicine or drugs are in ...

Explore More

Explore More

Blog

FBO Accounts and Fintech – Securing Financial Operation with ID Verification

With global digitization, online financial services are becoming mainstream. Due to this, maintai...

Explore More

Explore More

Blog

A Quantitative Insight into the Global Gaming and Gambling Industry

The gaming and gambling industry has demonstrated exponential growth in the past decades and is e...

Explore More

Explore More

Blog

Know Your Patient (KYP) | 4 KYP Compliance Trends for 2024

Nothing is more constant than change, and this is never more evident than in the Know Your Patien...

Explore More

Explore More

Blog, Financial Crime / AML, Fraud Prevention, Identity & KYC

Facial Recognition: Worries About the Use of Synthetic Media

In 2019, 4.4 billion internet users were connected to the internet worldwide, a rise of 9% from l...

Explore More

Explore More

Blog

Online ID Verification – A Solution to Tax Refund Fraud

An increase in identity theft and tax fraud have become a major concern these days. Criminals are...

Explore More

Explore More

Blog

Financial Regulations Against Crypto Sanctions Evasion in the UK – Is the Crypto Sector Safe?

Many governments throughout the world are facing concerns of money laundering and sanctions evasi...

Explore More

Explore More

Blog, Financial Crime / AML

AMLD5 Amendments in Prepaid Cards Transaction Threshold

In July 2018, the European Commission came into effect the 5th Anti-Money Laundering Directive (A...

Explore More

Explore More

Blog, Online Marketplace

Nordic Banks brace for Digital KYC with centralized Database

Five major Nordic banks have formed a partnership to establish a company that will compile a cent...

Explore More

Explore More

Blog

Transaction Screening: The Benefits and Challenges

Financial crimes are rising, wreaking havoc on organisations and individuals. The fraud rate has ...

Explore More

Explore More

Blog

Securing Identities in the Age of AI with Facial Recognition Technology

Although the digital revolution has brought us unprecedented levels of connectivity and comfort, ...

Explore More

Explore More

Blog

Prevailing Financial Crimes and AML Regulation in Argentina – How Shufti Can Help

Argentina has faced many significant challenges due to its geographical location, including the f...

Explore More

Explore More

Blog

What is Biometric Consent Authentication?

Biometric Consent Authentication is a modernistic approach to counter the increasing number of id...

Explore More

Explore More

Blog

Lithuania’s AML Regulations – How the EU’s FinTech Hub Prevents Financial Crime

Emerging FinTech firms around the world spend almost one-third of their overall budgets on develo...

Explore More

Explore More

Blog

Fintech Compliance – Boogeyman for Trillion Dollar Industry?

Fintech industry is flexing its muscle by bringing onboard more and more customers and innovating...

Explore More

Explore More

Blog

The 5 Pillars of Anti-money Laundering Compliance

Imposters often “launder” money acquired through illegal activities, like drug trafficking, so th...

Explore More

Explore More

Blog

June 2023 Recap: Major AML Violations and How Can Shufti Help

In global financial systems, the increasing frequency of Anti-Money Laundering (AML) violations h...

Explore More

Explore More

Blog

AML/KYC 2020 – how 2019 changed the landscape of global regimes?

Copy pasting your 2019 AML/KYC compliance strategy to 2020 plan will not do the job. Businesses n...

Explore More

Explore More

Blog

KYC For Sharing Economy – Building a Safe & Trusted Environment that Retains Customers

“Sharing Economy” is a term that has become popular in recent years, and the current digital worl...

Explore More

Explore More

Blog

Prevalent Crimes in Forex Industry – How Shufti Can Help in Mitigating Financial Crimes

Emerging technologies and digitization are transforming the investment sector, creating opportuni...

Explore More

Explore More

Blog

Insights Into Austria’s Biometric KYC Onboarding [2022 Updates]

Biometric authentication is considered a convenient approach for onboarding online customers that...

![Insights Into Austria’s Biometric KYC Onboarding [2022 Updates] Insights Into Austria’s Biometric KYC Onboarding [2022 Updates]](https://shuftipro.com/wp-content/uploads/b-img-austria.png) Explore More

Explore More

Blog, Fraud Prevention

Looking for Online Fraud Prevention: Here Is What You Can Do

In an increasingly digital world, it is extremely important for online businesses to identify fra...

Explore More

Explore More

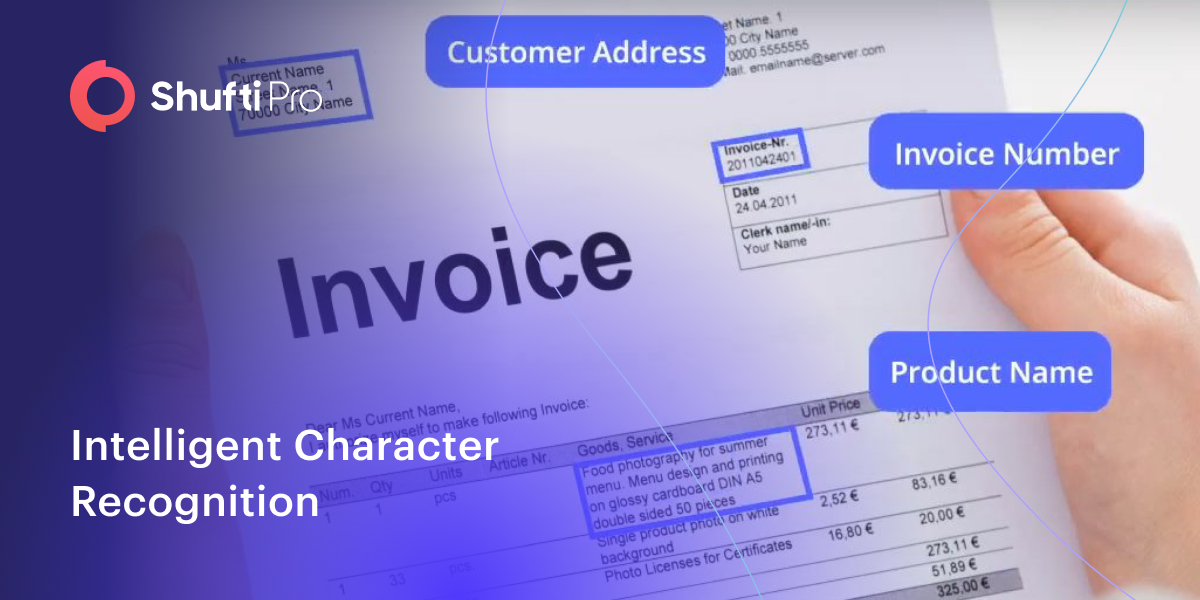

Blog

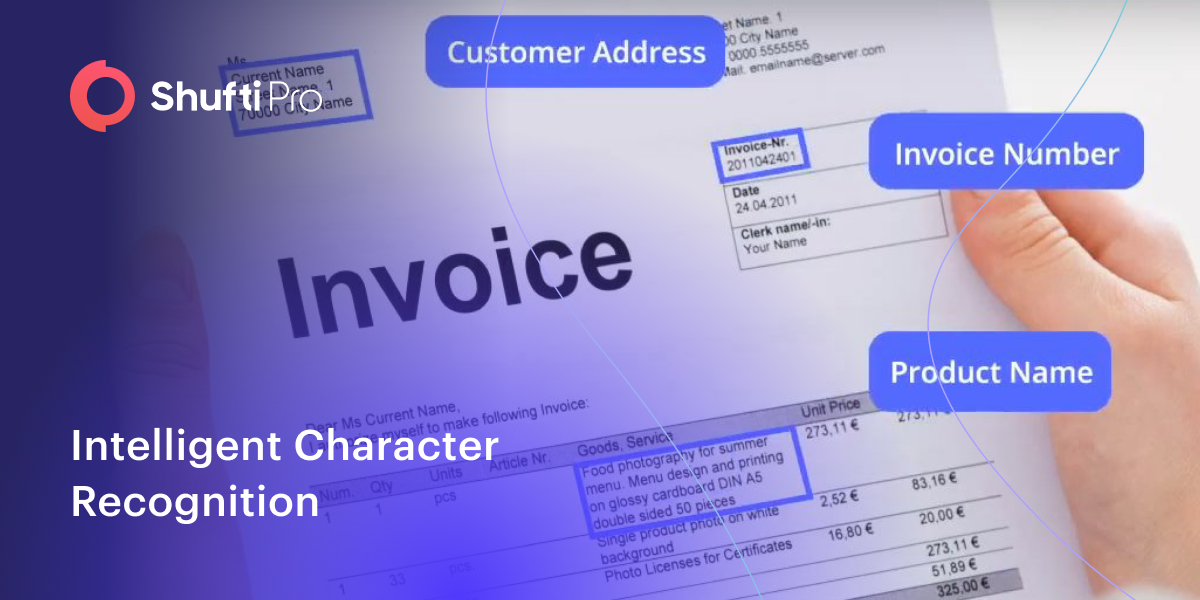

A Basic Guide to Intelligent Character Recognition (ICR)

With technological advancement, businesses are finding new ways to leverage digital sol...

Explore More

Explore More

Blog

Identity Document Verification | Revolutionising Customer Onboarding

Companies worldwide are undergoing a radical digital transition to keep up with today’s lig...

Explore More

Explore More

Blog

Top 10 Technology Trends in the Travel Industry to watch for in 2022

The travel industry is one of the worst-hit sectors from the coronavirus outbreak, which disturbe...

Explore More

Explore More

Blog

Top 8 Facial Recognition trends to watch in 2020

Facial recognition has been gaining prominence in recent times, owing to the benefits it offers o...

Explore More

Explore More

Blog

A Brief Overview of KYC Requirements for Foreign Exchanges in EMEA

The forex industry is recognizable for being a dynamic and profitable platform due to its high li...

Explore More

Explore More

Blog

Uncovering 5 Holiday Season Scams and How to Avoid them this Year

‘Tis the season when the best deals of the year are attracting customers towards online shopping ...

Explore More

Explore More

Blog

e-IDV: The Key to Fraud Prevention in FinTech

After years of enormous growth, investment in the fintech market declined in 2022. Susceptibility...

Explore More

Explore More

Blog

ICOs blocking investors from USA and China – Why and How?

Initial Coin Offerings, more commonly known as ICOs, are all the rage in modern day financial wor...

Explore More

Explore More

Blog, Online Marketplace

Fraud Protection services for Online Retail Businesses

Online Marketplace faces Chargeback issues

Fraud Protection Services are an integral part of reta...

Explore More

Explore More

Blog

A Detailed Insight Into Canadian Gambling Industry [2022 Update]

Even though Canada is not among the world’s gambling capitals, this business thrives there. The c...

![A Detailed Insight Into Canadian Gambling Industry [2022 Update] A Detailed Insight Into Canadian Gambling Industry [2022 Update]](https://shuftipro.com/wp-content/uploads/n-img-canadian-comp.png) Explore More

Explore More

Blog

The 5 Pillars of Anti-money Laundering Compliance

Imposters often “launder” money acquired through illegal activities, like drug trafficking, so th...

Explore More

Explore More

Blog

July 2023 Recap: Major Compliance Events and How AML Verification Can Help

Anti-Money Laundering (AML) violations pose a substantial and concerning threat to the reliabilit...

Explore More

Explore More

Blog

Antiquities Market – A Conduit of Money Laundering and Terror Financing

Money laundering and terror financing through art and antiquities has been a concern of regulator...

Explore More

Explore More

Anti Money Laundering, Blog, Financial Crime / AML

US Treasury opposes European Commission AML Country List

The European Commission has adopted a new list of 23 countries which lack appropriate framework f...

Explore More

Explore More

Blog

UAE’s Crypto Landscape – Eliminating Financial Crime to Ensure Regulatory Compliance

The UAE is the Middle East’s rapidly growing cryptocurrency hub that is experiencing a heated-up ...

Explore More

Explore More

Blog

Surging Crimes in NFT Marketplaces – Setting New Security Standards Using Shufti’s AML Solution

The emergence of Non-Fungible Tokens (NFTs) has created new investment opportunities for business...

Explore More

Explore More

Blog

AML Compliance and Digital Banks – Understanding the Evolving Regulatory Landscape

The emergence of new technologies in FinTech, increasing use of digital currencies, and alternati...

Explore More

Explore More

Blog

AML Compliance – Eliminating Financial Crimes in FinTech Firms

The FinTech industry is growing rapidly across various sectors with investments and large-scale a...

Explore More

Explore More

Blog

OCR in Banking | Automating Data Extraction, Customer Onboarding, and ID Verification

The global Banking and Financial Services Industry (BFSI) is one of the most heavily regulated an...

Explore More

Explore More

Blog

ID verification Services – Why Paper IDs are inferior to Digital Cards?

ID verification services are at the forefront of making online marketplace transparent and ensuri...

Explore More

Explore More

Blog

UK Watchdogs Hit Financial Institutions with Record AML Fines in 2021

A dramatic increase in Anti-Money Laundering (AML) fines was seen in 2021 as financial watchdogs ...

Explore More

Explore More

Blog

FATF’s Stance on Digitizing FIUs and Adopting A Risk-Based Approach for VAs

The Financial Action Task Force (FATF) is tirelessly working to guide Financial Intelligence Unit...

Explore More

Explore More

Blog

The need for identity verification solutions spiking in demand

At present, we are living in a digital world. Everyone is on the internet which is an anonymous s...

Explore More

Explore More

Blog

E-KYC – The Next Step in the Evolution of KYC Verification

As the world shifts to digital applications, financial operations are being automated for added c...

Explore More

Explore More

Blog

eIDAS and eIDs – The Shift in Identity Verification in the EU & Beyond

In the digital world, ensuring the security of international transactions is the ultimate goal of...

Explore More

Explore More

Blog

Identity Verification – Safeguarding Pharmaceutical and Controlled Substance Sales

With emerging technologies, the pharmaceutical industry has transformed significantly, and rapid ...

Explore More

Explore More

Blog

An Insight into Online Dating Scams – How Identity Verification Helps

The impact of Covid-19 on businesses and the physical, mental health of individuals has been stre...

Explore More

Explore More

Blog

Ensuring Compliance and Securing Business Reputation – How Shufti Can Help

In the highly digitized world, businesses are partnering with each other to serve mutual interest...

Explore More

Explore More

Blog

A Comprehensive Guide to Understanding Ultimate Beneficial Owners (UBOs)

Identifying UBOs and their control over a business is crucial for financial firms to meet regulat...

Explore More

Explore More

Blog

E-commerce Frauds – Common types and Prevention tips

What are some common e-commerce frauds and how can you prevent them? Is the buyer on your site an...

Explore More

Explore More

Blog

What 5 Businesses Have to Say About Shufti’s Digital AML/KYC Services

Various industries throughout the world are being transformed through automation thanks to the on...

Explore More

Explore More

Blog, Fraud Prevention

Internet of Things: B2B IoT Segments about to hit $300 Billion by 2020

The Internet of Things is growing exponentially with respect to its usage and capabilities. A who...

Explore More

Explore More

![Insights Into Austria’s Biometric KYC Onboarding [2022 Updates] Insights Into Austria’s Biometric KYC Onboarding [2022 Updates]](https://shuftipro.com/wp-content/uploads/b-img-austria.png)

![A Detailed Insight Into Canadian Gambling Industry [2022 Update] A Detailed Insight Into Canadian Gambling Industry [2022 Update]](https://shuftipro.com/wp-content/uploads/n-img-canadian-comp.png)